cares act illinois student loans

So over the next six months your federally held student loans will accrue no interest will accrue. Travis Hornsby CFA is Founder and CEO of Student Loan Planner.

The Full List Of Student Loan Forgiveness Programs By State

Allocates 25 billion in federal transit formula funding to keep public transit operating throughout Illinois in order to ensure continued access to jobs medical treatment food and other essential services.

. The first thing that the CARES Act does is set interest on student loans to 0 through September 30 2020. Education Stabilization Fund Transparency Portal March 17 2021 Covid-Relief-Dataedgov is dedicated to collecting and disseminating data and information about the three primary ESF programs that the Coronavirus Aid Relief and Economic Security CARES Act authorized and the Department manages. However the CARES Act left out millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders.

Student Loan Debt. Do Your Investments Align with Your Goals. Illinois transit agencies will receive an estimated 16 billion in federal.

The Coronavirus Aid Relief and Economic Security CARES Act provides additional flexibility for student loan borrowers during the Coronavirus Outbreak including automatically suspending. Kristen Thometz April 21 2020 457 pm. As one of the nations leading student loan experts he has consulted on 500 million of student debt personally.

Once youve decided to go to college understanding how student loans work is the next big step. The 880-page Coronavirus Aid Relief and Economic Security Act CARES has 4 pages of help for certain student loan borrowers. Of that money approximately 14 billion was given to the Office of Postsecondary Education.

Department of Education between March 13 2020 and August 31 2022. Allocates 25 billion in federal transit formula funding to keep public transit operating throughout Illinois in order to ensure continued access to jobs medical treatment food and other essential services. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020.

What Does the CARES Act Say About Student Loans. The CARES Act wants to make those payments more manageable in times like now. The cares act and employer student loan contributions update 1227.

Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act. Find a Dedicated Financial Advisor Now. The CARES Act and Employer Student Loan Contributions Update 1227.

Pritzker said this newly approved. The CARES portal can be found at httpscaresapphfsillinoisgov. But theres more to the CARES Act than just handing out checksit also comes with some changes in favor of borrowers specifically those with student loans.

Pritzker said the state has secured relief options for student loan borrowers who werent previously covered by the federal CARES Act which provides relief to those with federal loans but not to those with. The CARES Act Covers These Student Loans. HFS will consider the amount of COVID-related funding providers are receiving.

He lives with his wife in St. There are many benefits to student borrowers due to the CARES Act. The short answer is that the CARES Act does not directly affect your private student loans with one exception.

For most borrowers all federal student loan payments and accrual of interest has been waived until September 30 2020. It provides meaningful albeit temporary help for those who qualify by having the right kind of student loan. Believe it or not there are 429 million borrowers who put together owe about 16 trillion in federal student loan debt.

Illinois residents who are struggling to make student loan payments could soon get some relief. Section 3513 of CARES. HFS will make final funding and policy decisions based on federal and state laws regulations and guidance.

This bill allotted 22 trillion to provide fast and direct economic aid to the American people negatively impacted by the COVID-19 pandemic. When the cares act passed in march of 2020 it provided borrowers with federally held loans numerous benefits. Stafford loans and Pell grants received for an incomplete semester do not count towards the total number of loans or grants the student.

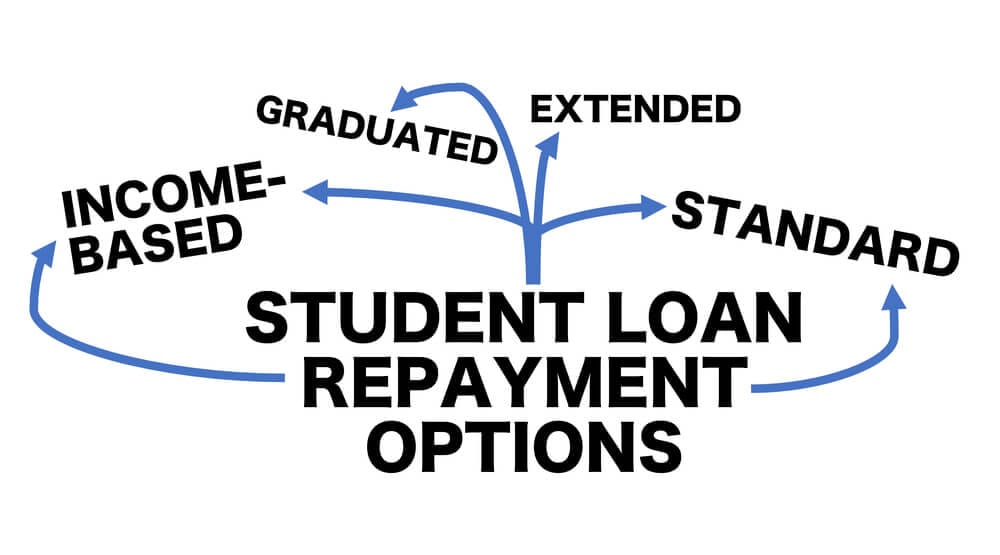

Nevertheless private student loans total about 125 billion. Suspends student loan monthly payments for 6 months. One of its most well-known provisions concerns the repayment of federal student loans.

The cares act and student loan repayment. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. Student Loan Debt.

CARES Act Emergency Relief. Under this new initiative Illinoisans with commercially-owned Federal Family Education Program Loans or privately held student loans who are struggling to make their payments due to the COVID-19. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

The portal is open from September 29 2020 through noon on Saturday October 31 2020. Under the new law no payments are required on federal student loans owned by the US. Illinois transit agencies will receive an estimated 16 billion in federal.

Louis MO where he loves thinking up new student loan repayment strategies and frequenting the best free zoo in America. Suspended payments under the CARES Act may not be reported as a missed payment. One component of this relates to when students have to repay their debt.

Allows employers to contribute up to 5250 through the end of the year to each workers student loan debt tax free. This means if you filled out the FAFSA and borrowed loans as a result your loans might be affected. This doesnt mean there arent options available for you to obtain financial relief during these difficult times though.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Sunday December 26 2021. In addition the interest on these federal student loans will automatically drop to zero percent.

Your employer can provide up to 5250 tax-free to reimburse you for student loan payments or tuition assistance through Dec. Suspends student loan monthly payments for 6 months. The CARES Act provided relief for small businesses and laid off workers.

A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. The CARES Act has two big impacts on federally held student loans.

Home Unlabelled Cares Act Illinois Student Loans - Financial Aid Eastern Illinois University. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees student loans has been extended from the previous deadline of. This order suspended all payments on Direct Loans through December 31 2020.

Students with federal student loans.

The Cares Act And Student Loans A Guide I Morgan Stanley At Work

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Many Student Loan Borrowers Missed A Chance To Exit Default Money

Student Loan Scams 3 Warning Signs To Watch For Money

Student Loan Forgiveness Programs Credible

What To Know About The Debate Over Student Loan Forgiveness Npr

More Companies Are Wooing Workers By Paying Off Student Debt Money

How To Get A Student Loan Money

Current Student Loans News For The Week Of Jan 17 2022 Bankrate

Tuition Assistance Student Loans Student

Income Based Repayment Of Student Loans Plan Eligibility

Who Owes The Most In Student Loans New Data From The Fed

Student Loan Forgiveness Programs The Complete List 2022 Update

6 Best Student Loans Of 2022 Money

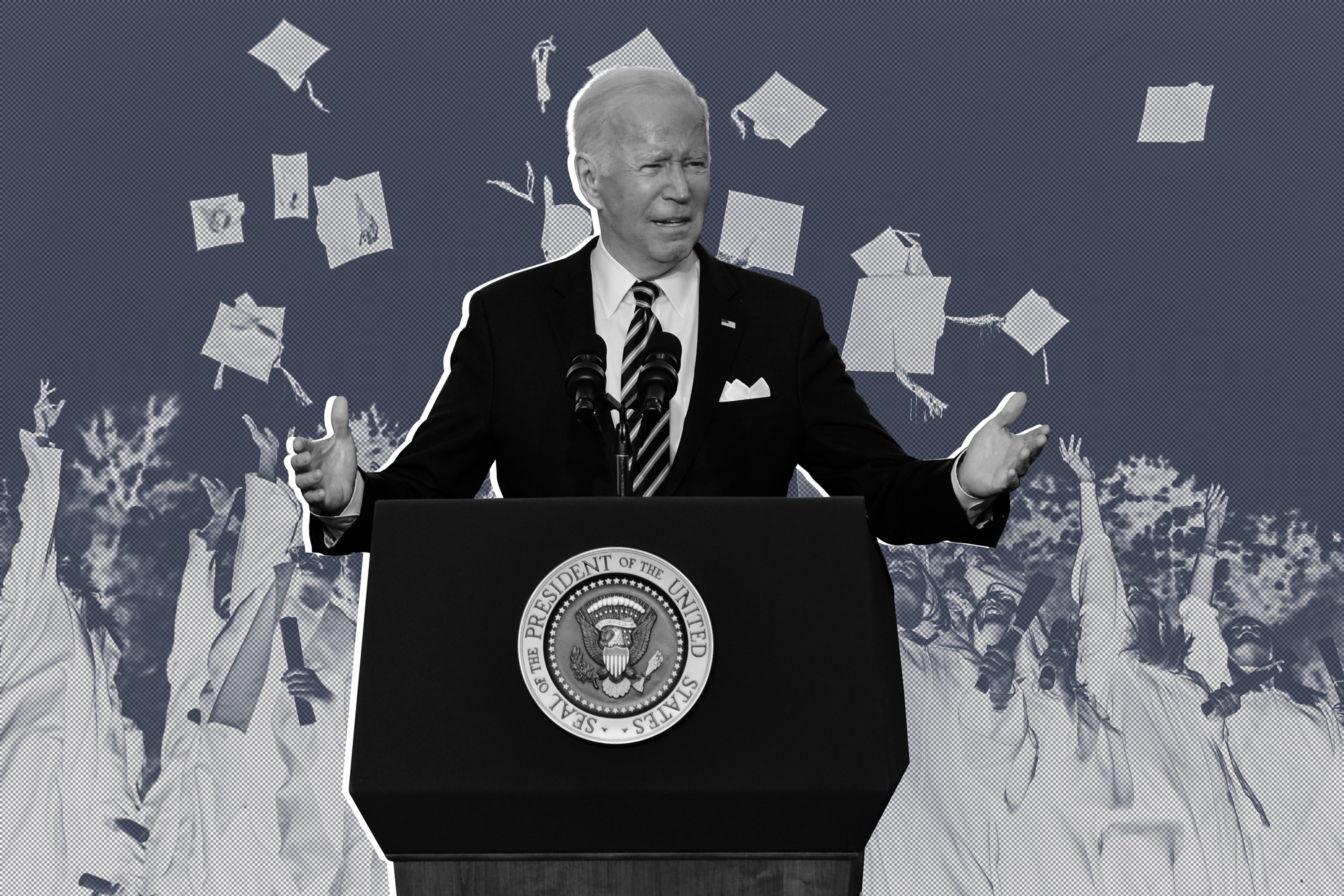

What Did Biden Actually Promise On Student Loan Forgiveness Money

Big Changes To Student Loan Bankruptcy Rules May Be Coming But Questions Remain

Make Student Loan Debt Dischargeable In Bankruptcy Again

Statute Of Limitations On Private Student Loans State Guide Credible